Here’s a quick recap of what happened in the world of finance this year:

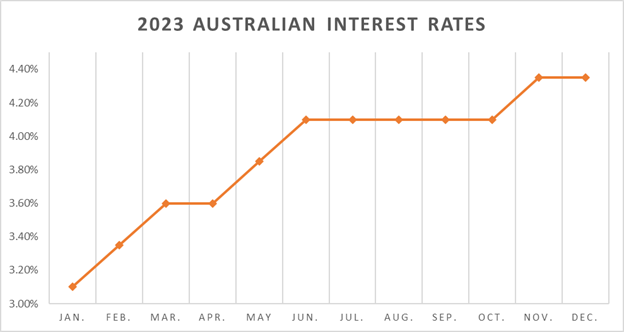

- Responding to rising inflation, the Reserve Bank of Australia kept hiking up interest rates, capping out at 4.35% in November and holding that steady through December.

- Many households added another source of income to cope, causing the unemployment rate to fall to a 48-year low.

- Residential listings soared, and housing prices increased, with Perth and Brisbane reaching record highs.

- Boosted by China reopening its trade, Australian stocks achieved a +14.8% return this year.

Let’s dive in deeper.

Inflation and Interest Rates

In 2022 we saw a major rise in inflation, largely due to supply disruptions and the war in Ukraine. By the start of this year, those rates were approaching levels that had a lot of people deeply worried.

In an attempt to curb inflation, the Reserve Bank of Australia (RBA) hiked up interest rates more sharply than it had in decades—some say too sharply. High rates are still crippling consumer spending, both in the goods and services spaces. Goods inflation hit its high in June of this year before starting a very slow descent, but services inflation took longer, hitting its high in September.

The inflation rate for the third quarter of 2023 fell to 5.4% year-on-year, which is the lowest it’s been since the first quarter of 2022. While the rate held steady at 4.10% June through October, it rose again in November to 4.35%. At its final meeting of the year, the RBA chose to leave the cash rate on hold at 4.35%.

Labour and Unemployment

While rising inflation has put more of a strain on Australian households, there’s good news as well: the labour market is stronger than ever. The unemployment rate has reached 3.4%, the lowest it’s been in 48 years. Most households have added a second income to keep up with the increased costs of rising interest rates.

This is largely the reason why inflation hasn’t hit all Australians as hard as you might expect: while it’s still a significant strain on many, most people have the financial resources to at least cope.

Property and Construction

Rents and mortgage borrowing rates have followed rising interest over the past couple years, and a rise in construction costs, plus delays caused by a shortage of labour and material, led to a pause in housing construction in 2022 that continued into 2023.

But housing prices bounced back in April (after bottoming in February); and in August, an influx of new listings rose above the five-year average. Despite the property listings boom, prices continued to rise throughout the year. Compared to peak 2022 prices (from April 2022), Perth and Brisbane are at record highs, while Sydney is down 1.8% and Melbourne 3.6%. Overall, housing prices nationwide have risen about 5% in 2023.

When it comes to office and industrial property, the move to remote work is still playing havoc with rental rates. Many offices are now vacant, and lower demand has led to lower rental rates. Most major inner cities are seeing a steady influx of people returning to work in offices, with a new trend towards co-working offices.

But industrial property is still highly in demand, as the demand for warehouses and distribution spaces increases. And if the labour market continues to grow, demand for office spaces could bounce back as well. Many employers are trying to entice employees back, which could mean more investments in high-quality office spaces that offer perks.

Stocks and the Global Market

Despite being under pressure this year, Australian stocks achieved a +14.8% return, no doubt boosted, like stocks in the rest of the world, by China’s trade reopening toward the end of the year.

Not surprisingly due to the rise in tech and AI this year, IT was the strongest performing sector around the world. Tech stocks in Australia brought in a total return of 38%, matching the rates for stock in other countries.

In both Australia and the U.S., short-end rates (fixed income rates for short-term securities that will mature in one year or less) rose above long-end rates (fixed income rates for securities that will mature in 10 years or more), which is usually something that happens before an economic recession. Then, several U.S. banks failed, which had a lot of people worried we were indeed heading into a recession. But by the end of the year, rates had returned to normal.

Looking forward

While Australia, like the rest of the world, has faced its share of economic challenges recently, the economy grew more than most other countries in 2023, thanks largely to exports and a rise in immigration.

The unemployment rate is at a historic low, and although inflation is still high, there’s reason to hope we’ve seen the worst of it. So as we move into the new year, maybe you can let out that breath you’ve been holding since late 2021…or 2020…or whenever. Our economic troubles certainly aren’t over, but the future looks bright.