Taking care of your loved ones and your legacy

An estate plan isn’t just for the elderly

Death is a certainty that we will all experience at some point. While the time and manner of our departure is most likely a mystery to us, with careful planning we can minimise the impact on our loved ones and ensure our legacy reflects how we would like to be remembered.

A common misconception is that estate planning is mainly for the elderly. Unfortunately, people can pass away at any age whether through illness, accidents or natural causes. In many cases, it can be sudden or unexpected so you may not have the time until old age to draw up an estate plan.

While having a Will in place is a good start, a properly constructed estate plan should consider a broad range of issues such as:

Mental incapacity

Family conflict

Financial shortfall for your beneficiaries

Leakages due to tax

Protecting vulnerable beneficiaries

Mental incapacity

Family conflict

Financial shortfall for your beneficiaries

Leakages due to tax

Protecting vulnerable beneficiaries

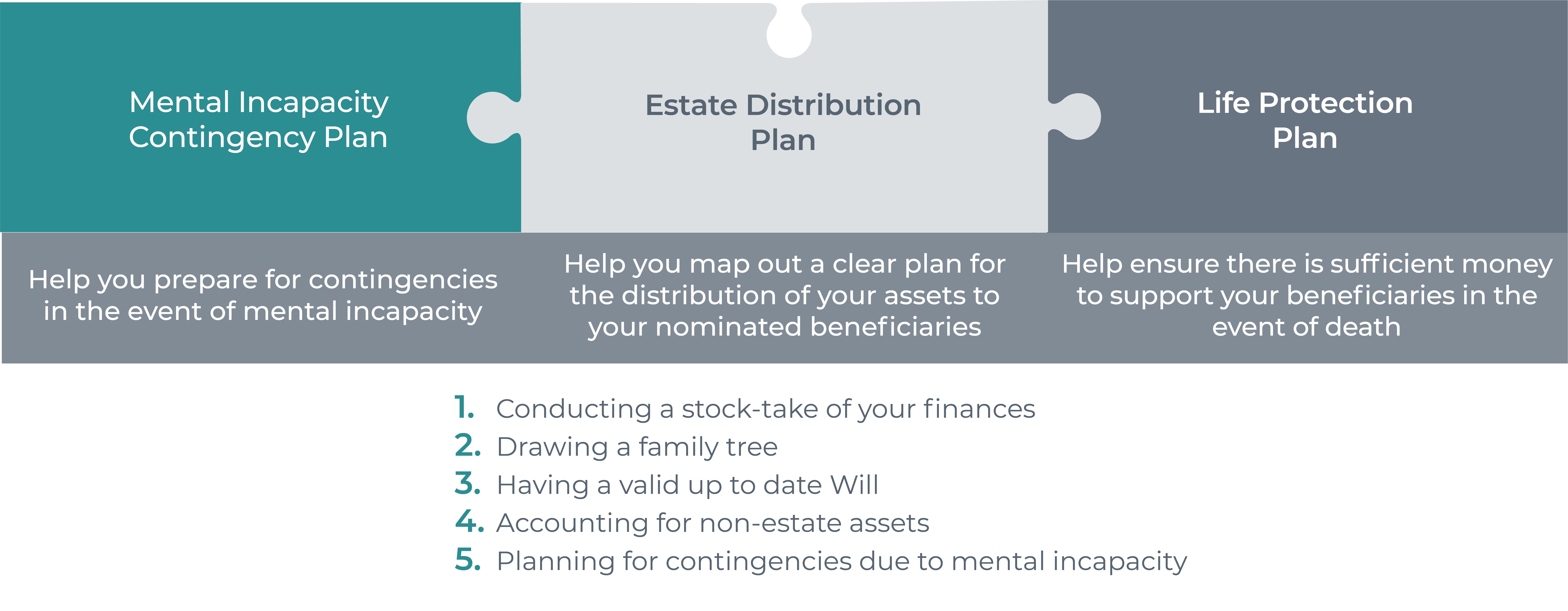

Tribel’s Estate Planning options

Our financial planners take an empathic approach to estate planning ensuring those who remain stay front and centre.

Our three estate plans legally securing your interests, help avoid family stresses, manage issues with creditors or assets still under loan, trigger insurance policies, minimise tax associated with the transfer of assets, and cover possible eventualities such as mental incapacity (allowing others to make important decisions on your behalf).

Want more information? Download our brochure on Estate Planning or get in touch with us to discuss.