People pass away but your business doesn’t have to

Buy/Sell Agreement

Without a business succession plan, the death or disablement of a business partner could be catastrophic. However, many small businesses fail to address succession planning believing that such a catastrophe will not happen, considering the process is too long or too expensive or putting succession planning off when things “quieten down”.

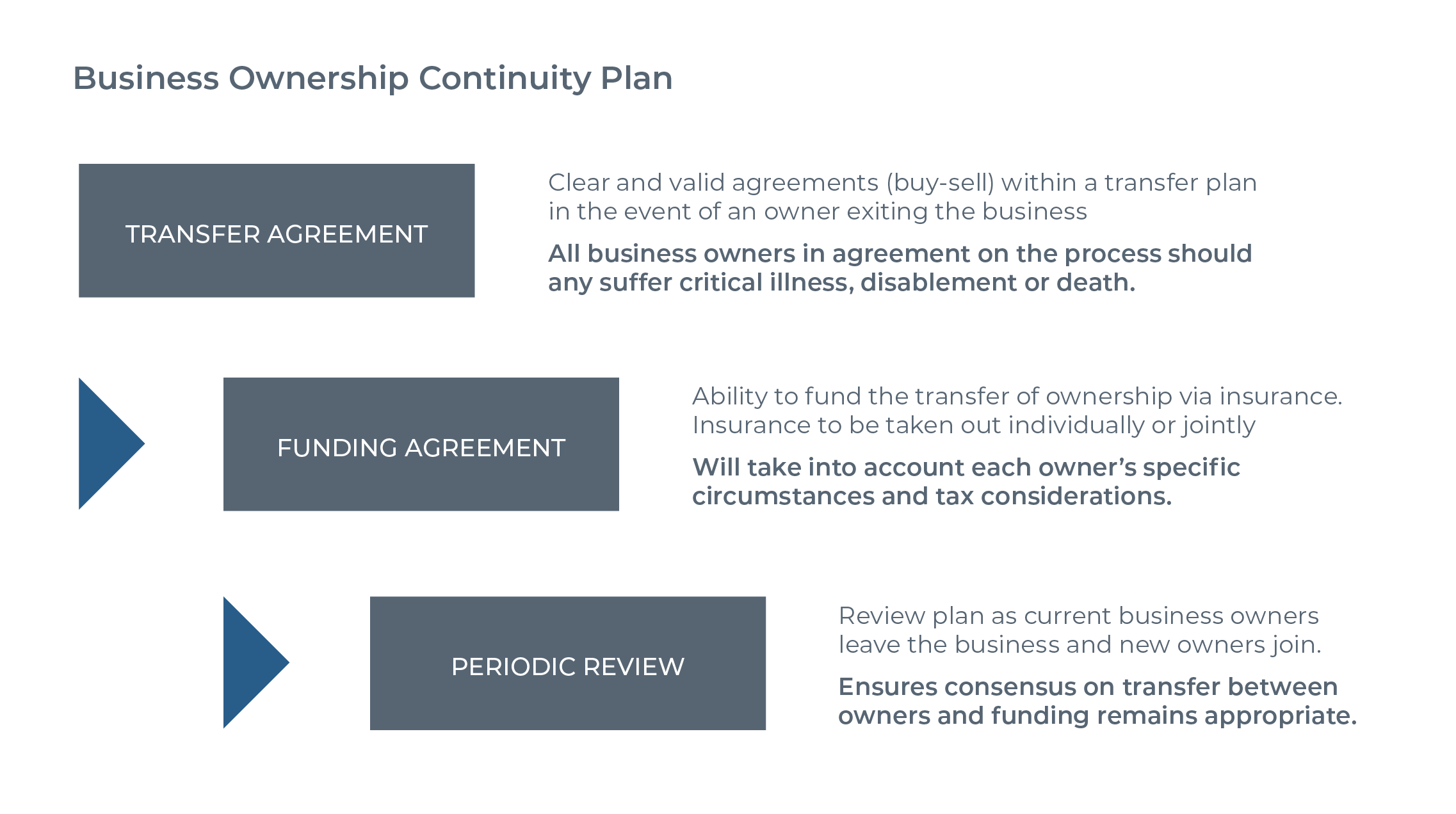

A buy/sell agreement is an arrangement for the transfer of a deceased or disabled owner’s interest in the business to the remaining owners. This ensures that the departing owner (or their family or estate) receives fair market value for their interest in the business. It also ensures the remaining owners have exclusive ownership and control of the business.

Insurance is commonly used to fund the purchase of the business interest under a buy/sell agreement. This is because an insurance funded buy/sell agreement avoids the need for the remaining owners to finance the purchase of the business using additional debt or using other resources.

Want more information? Download our brochure on Ownership Succession or get in touch with us to discuss.